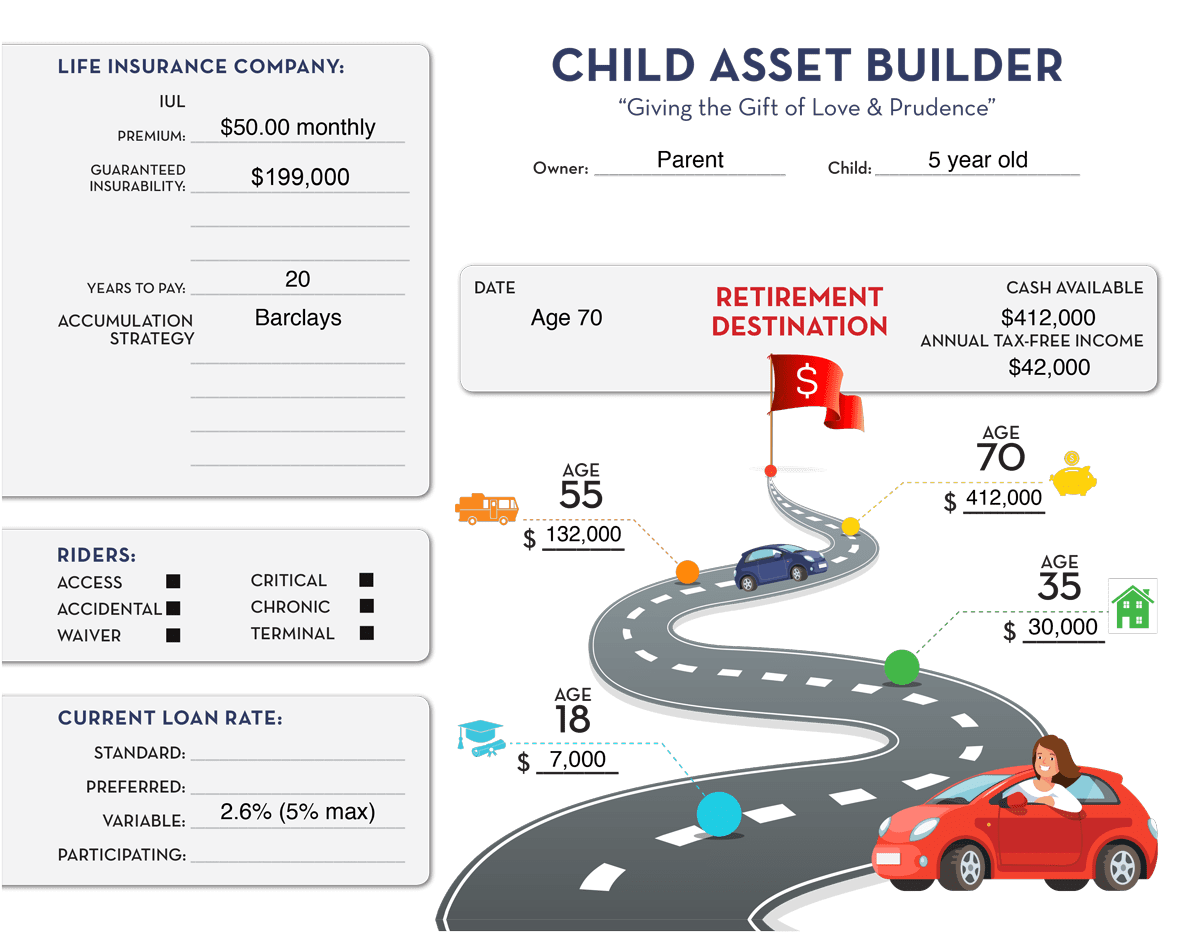

Child Asset Builder:

Giving the gift of love and prudence

Guaranteed insurability

College and emergency funding

A source of supplemental tax free income

Tax deferred accumulation

Leave a generational legacy

You can Leave a Legacy

All of us love our children and grandchildren, but we might not be around to guide them through the financial challenges. Why not leave a legacy of helping them get a head start on savings? Below is an example of what a Child Asset Builder could look like for your child or grandchild.

Birthday Celebrations, How do you celebrate?

Ok- here is what I learned (and it keeps me from heartbreak)- There is a holiday every time I turn around. Most of them. ALL of them...celebrate someone or something other than ME!

Life Insurance should be a priority in your financial plan

If your budget is tight, term insurance may be the right solution for you. I urge you to face the facts and consider what would happen to your family if you died too soon without a plan in place.

Sources based on the data shared by Rex Nutting-Market Watch (2016), Surveys conducted by OnePoll for LifeHappens.org (2020), plansponsor.com article retirement concerns remain (2019).

[et_pb_dcgd_gravity_divi_module dc_dgfcm_form_id="2" _builder_version="4.24.0" _module_preset="default" hover_enabled="0" global_colors_info="{}" dcgm_button_text_color__hover_enabled="on|hover" dcgm_button_text_color__hover="#000000" sticky_enabled="0" field_required_text_color="#FFFFFF"][/et_pb_dcgd_gravity_divi_module]